how does inheritance tax work in florida

An inheritance tax is a state tax you have to pay on property or money you receive from someone who has passed away. The federal government however imposes an estate tax that applies to residents of all states.

Inheritance Tax In Switzerland Guide Rules For Estates Studying In Switzerland

Ncome up to 40400 single80800 married.

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

. Inheritance taxes are tied to the state where the decedent resided and passed away. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met. If the person giving them the property lived in one of the six states that do levy an inheritance tax that state would collect an estate tax.

In Florida your surviving spouse inherits your entire estate if there are no surviving children or if any children also are your surviving spouses children. How Does Inheritance Tax Work in Montana. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

If an individuals death occurred prior to that time then an estate tax return would need to be filed. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. The fact that Florida has neither inheritance nor estate taxes on the state level does not mean that the states residents dont have to worry about the Death Taxes at all.

A tax is also levied on notes bonds mortgages liens and other written obligations to pay that are filed or recorded in Florida. The standard Inheritance Tax rate is 40. If someone dies in Florida Florida will not levy a tax on their estate.

Income over 40400 single80800 married. The strength of Floridas low tax burden comes from its lack of an income tax making them one of seven such states in the US. A very small number of states have inheritance taxes and again Florida is not one of them.

You dont have to pay inheritance taxes on an inheritance in Florida. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Florida doesnt collect inheritance tax.

Florida also has no gift tax. Youll need to check the laws of the state where the person you are inheriting from lived. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state.

Florida also does not assess an estate tax or an inheritance tax. The rate for these types of contracts is 35 cents per 100 of value. Dont confuse the inheritance tax with the federal estate tax which is tacked on estates worth more than 117 milllion.

Tax is usually assessed on a sliding basis above those thresholds. This applies to the estates of any decedents who have passed away after December 31 2004. A stamp tax of 70 cents per 100 of value is assessed on documents that transfer interest in Florida real estate such as warranty deeds and quitclaim deeds.

However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax. Its only charged on the part of your estate thats above the threshold. If you are survived by children who are not those of your surviving spouse your spouse inherits half of the estate and the children inherit equal shares of the remaining half.

Florida does not have a separate inheritance death tax. The state constitution prohibits such a tax though Floridians still have to pay federal income taxes. Inheritance taxes are not paid according to where the beneficiary lives and if an out-of-state relative left you an inheritance you would not have to pay taxes on it unless the state they resided in had inheritance taxes.

There is no federal inheritance tax but there is a federal estate tax. In 2021 federal estate tax generally applies to assets over 117 million. However its important to point out that with estate and inheritance taxes these taxes could apply to the.

Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. The tax rate varies depending on the relationship of the heir to the decedent.

And while Florida does not have a state. However there are cases when inheritance comes with a certain level of fiscal burden. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

Most people know nothing about inheritance taxation until they become responsible for the Death Tax due. Individuals and families must pay the following capital gains taxes. Income over 445850501600 married.

As with estate tax an inheritance tax if due is applied only to the sum that exceeds the exemption. There are no inheritance taxes or estate taxes under Florida law. The applicable tax rates will be reduced an additional 20 for each of the following three years.

While the estate tax is calculated and taken out from the estates worth before it is passed to heirs inheritance tax is directly the heirs responsibility. An inheritance tax is a tax imposed on specific assets received by a beneficiary and the tax is usually paid by the beneficiary not the estate. The inheritance tax in Florida is the legal rate at which the state of Florida taxes the estate of a deceased person.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. The tax rates listed below have already been reduced by.

Montana does not impose an inheritance tax on its residents. The state where you live is irrelevant. For deaths occurring on or after January 1 2025 no inheritance tax will be imposed.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. An inheritance tax is a tax levied against the property someone receives as an inheritance.

Florida Probate Access Your Florida Inheritance Immediately

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Inheritance Tax Beginner S Guide Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

![]()

Florida Inheritance Tax Beginner S Guide Alper Law

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

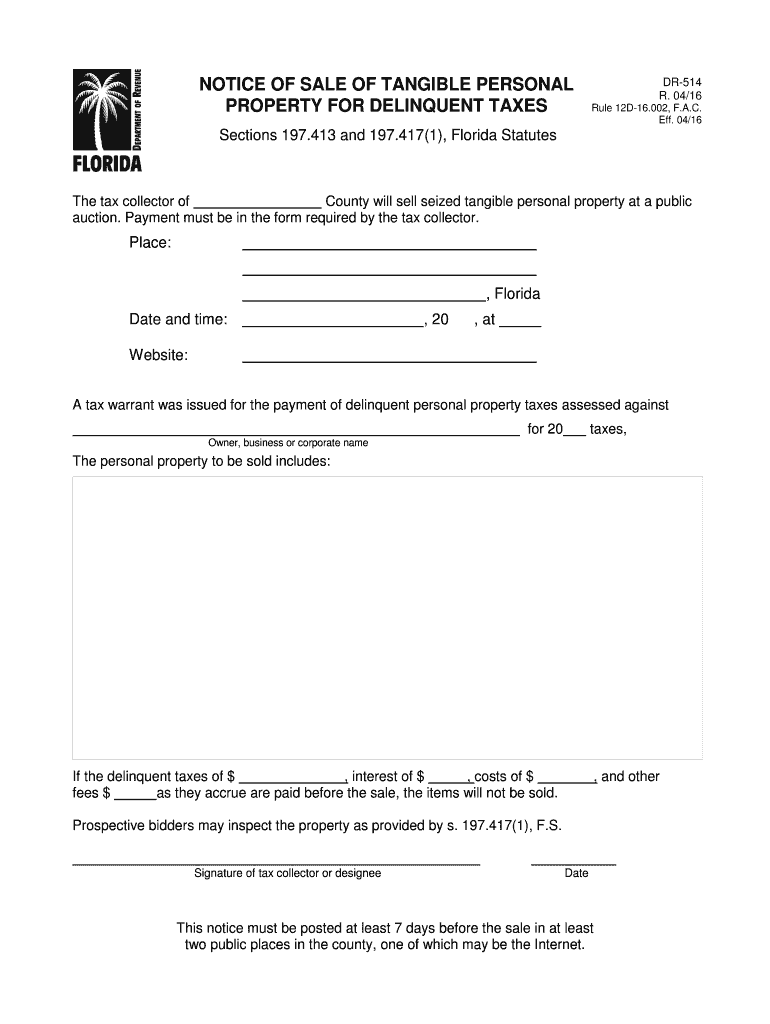

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

Florida Estate Tax Rules On Estate Inheritance Taxes

What Taxes Do I Have To Pay If I Receive An Inheritance In Florida St Lucie County Fl Estate Planning Attorneys

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)